If you’ve lived in South Africa long enough, you know how quickly money can become a problem. One day, everything’s fine. The next, your car breaks down on the N1, the fridge gives up in the middle of summer, or your child needs urgent school supplies. These are the moments when waiting until payday just isn’t an option.

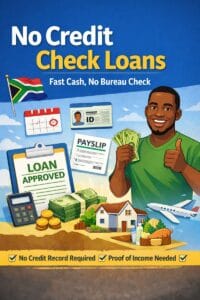

That’s where same day loans with no upfront fees come in. They’re designed for emergencies — quick cash you can actually access today, without the stress of being scammed by fake lenders who ask you to “pay a fee” before giving you a cent.

For many people across Mzansi, these loans aren’t about luxury or showing off. They’re about survival, dignity, and getting through the month without borrowing from every friend and family member.

What Makes These Loans Different?

The term same day loan says it all — you apply, get approved, and the money is in your bank account on the same day. But what really matters here is the “no upfront fees” part.

Too many South Africans have been caught by fraudsters. The scam usually goes like this: you apply for a loan, they say you’re approved, but before you can get the money, you must pay a “deposit”, “insurance”, or “processing fee”. Once you send the cash, they disappear.

Legitimate lenders don’t work like that. If they’re registered with the National Credit Regulator (NCR), it’s illegal for them to ask you for money before paying out your loan. The costs — interest, service fees, and so on — are built into your repayments. That means you only start paying after the loan is in your account.

This is what makes no-upfront-fee loans safer and far more trustworthy than shady offers you see on WhatsApp groups or dodgy websites.

How the Process Works

The process is surprisingly simple, and that’s why more South Africans are using these loans. Here’s how it usually goes:

- Online application: Most lenders now let you apply online, so no standing in queues or wasting transport money.

- Documents: You’ll need a South African ID, proof of income (like payslips or bank statements), and a valid bank account.

- Quick approval: Instead of digging into your full credit history, lenders check if you can afford the repayments right now.

- Same-day payout: If you qualify, the money can land in your account within hours.

Imagine this: your car breaks down on the way to work, and the mechanic says it’ll cost R2,500. Instead of panicking, you apply in the morning, get approval by lunchtime, and have the cash in hand to settle the bill before the day ends. That’s the power of same day loans.

Why “No Upfront Fees” Matters So Much

South Africa has no shortage of loan scams. Sadly, these scams target the very people who are already struggling financially. Think about it: if you’re desperate for money, you’ll do whatever it takes, even if it means paying R500 upfront in the hope of getting R5,000.

But here’s the truth: if a lender asks you for money before you receive your loan, walk away. It’s a scam. Real lenders don’t do that. The NCR has strict rules in place to protect consumers, and upfront fees are simply not allowed.

That’s why the phrase “no upfront fees” is so important. It’s not just a nice marketing line — it’s your shield against being tricked out of your hard-earned money.

The Good and the Not-So-Good

Like anything in life, same day loans have their pros and cons.

The Good:

- You get the money fast — usually the same day.

- It’s convenient — most applications are done online.

- Your credit score isn’t the main barrier — affordability matters more.

The Not-So-Good:

- Interest rates are higher than traditional bank loans.

- Repayment terms are short, often linked to your next payday.

- If used too often, they can lead to a cycle of borrowing.

The key is balance. If you only borrow when absolutely necessary and take an amount you know you can repay, same day loans can be a lifesaver. But if you use them to cover luxuries or roll them over month after month, you’ll soon feel the pressure.

Borrowing Smart in South Africa

Here’s some advice that can make your experience safer and less stressful:

- Check registration: Only borrow from lenders registered with the NCR.

- Read the fine print: Even if you’re in a rush, skim through the terms so you’re not caught off guard.

- Use a calculator: Many websites offer repayment calculators — use them to see exactly what you’ll owe.

- Borrow small: Take only what you really need. Don’t borrow R5,000 if R2,000 will solve your problem.

- Stay honest: If you can’t repay on time, talk to your lender. They’d rather help you restructure than see you default.

Alternatives to Consider

A same day loan is helpful, but it’s not your only option. Depending on your situation, you might find relief elsewhere:

- Salary advance: Some employers allow staff to access part of their salary early.

- Stokvels: A trusted South African savings system that can provide access to group funds.

- Overdraft facility: If you already have a bank account, an overdraft can sometimes be cheaper.

- Friends and family: While not always easy, this option is often interest-free.

Exploring alternatives first might save you money, but when those aren’t available, a same day loan can step in.

Why Choose Instant Fund?

With so many lenders out there, it’s natural to feel uncertain about who to trust. That’s why people in South Africa have turned to Instant Fund. They’re transparent, NCR-registered, and most importantly, they don’t ask for upfront fees.

Their process is quick, simple, and designed for real-life emergencies. Whether you need money for medical bills, transport, or just to get through the month, Instant Fund makes sure you’re covered without the stress of being scammed.

Emergencies don’t wait for payday. When life catches you off guard, same day loans with no upfront fees can give you the breathing space you need without the fear of being scammed.

They’re not meant for long-term solutions, and they should be used responsibly. But when you choose the right lender and borrow wisely, they can truly be a financial lifeline.

For South Africans looking for a safe, reliable option, Instant Fund has proven itself as a trusted partner in times of need.