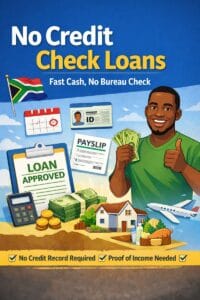

Payday loan are the most convenient financial option for all those people who cannot afford to repay back the entire loan amount in lump sum within short time span. These kinds of loans will let you pay off the borrowed finance in a number of payments in small easy payday loan, over a longer time period.

- Easy repayment term

- Understand your needs and grab the right loan amount

- Easy and smooth online application process

- A highly recommended loan plan

- Bad creditors can also qualify

- Draw comparison and fetch the best loan deal

- Complete the online loan application process in just few minutes

- Tailor-made financial solution

- Flexible lending criteria

- High cost loan offer

- Search, compare and find the right loan offer using online mode

Easy repayment term

Get ready to repay the loan amount in small payday loan, over a longer time span. Now you can spare yourself from repaying the full loan amount within shorter duration. Under these loans you can get enough funds to cope with some important unavoidable expenses with ease.

Understand your needs and grab the right loan amount

Getting funds with easy repayment term can be easy by just opting for payday loan no credit check. You should understand your needs first and then opt for an amount maximum up to R 5,000 to meet any important financial requirements that cannot be avoided. You can get the money on the basis of your needs and your ability to repay the loan. Make timely payments to avoid extra charges and penalties.

Easy and smooth online application process

For smooth and hassle-free loan applying experience, you must check out online medium. All you will have to do is fill in a payday online application form with the asked information and submit it. Provide your accurate details to avoid loan application rejection.

Your form will be processed and a quick response is given on your loan request. Once it is approved, funds will be directly deposited to your bank account in shortest possible time.

Are you urgently in need of small amount of funds to pay off small emergency bills? Looking forward to fetch a feasible loan offer with easy repayment term? Monthly urgent loans are what you should apply.

A highly recommended loan plan

They can be a fabulous funding offer for those who need money now and want to pay it back later in small parts. This effective loan solution will let you borrow sufficient amount of funds to pay off ant sort of unplanned expenditure on time. Repayment of the loan can be made in a number of small and predicted payments, usually on a weekly basis.

Bad creditors can also qualify

No matter whether you have good or bad credit rating, you can still qualify for these loans during exigency. No obligations will be imposed on your past credit issues as today are mainly focusing on your repayment capability.

Draw comparison and fetch the best loan deal

Prices for these loans fluctuate between lenders. So, it is important to estimate the total cost of the by using calculators available online. It is important to draw comparison for finding the right loan deal.

Complete the online loan application process in just few minutes

Fill up a payday online application form and submit it. Do mention your accurate details asked by lenders. Your details will be used for loan matching purposes and will always remain safe and secure. If your loan request is accepted, money will be directly wired to your checking account.

Facing cash crisis at midst of the month? Need extra cash to fix temporary cash trouble? Monthly payment loans are what you should apply. In times of emergency, you can rely on small monetary backing to get over with small unplanned expenditure without any delay.

Tailor-made financial solution

Upon approval against these loans you can derive an amount maximum up to R 1,000, based on your requirements as well as your repayment capacity. You will have to return back the borrowed loan amount and the interest charged within shorter time span of a month.

Flexible lending criteria

For availing these loans you should meet few basic preconditions. All you will have to do is attainment of minimum age of eighteen years or more, holding a valid healthy bank account for direct supply of funds, have a permanent citizenship of South Africa and also have full-time job proof with fixed monthly salary.

High cost loan offer

Higher rate of interest is been charged against these loans, because of its urgent cash loans nature of finances. Thus, you should pay it back within agreed time. Failed or missed payment may lead to penalties and late fee charges.

Search, compare and find the right loan offer using online mode

There is fierce competition going on among almost all top lenders and because of that their interest rates may differ. On collecting and comparing loan quotations from different reputed lenders, you can able to pick the most efficient loan offer that best suit your necessity.

Fill up a payday online application form with the required details and submit it. This is how you can apply for loans, without leaving your home comfort. Your form will be processed by lenders and if your loan request is accepted, funds will be directly credited into your bank account.