Let’s be honest, life in South Africa doesn’t always run smoothly. One week you’re fine, and the next your car decides to break down or an unexpected bill pops up. When payday is still a few days away, those small emergencies can feel huge.

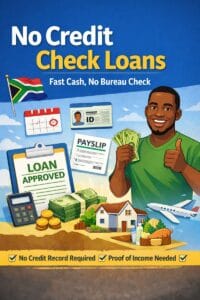

That’s when many people start looking for 1 hour payday loans. These loans are quick, simple, and they don’t stress too much about your past credit history. But before you take one, it’s worth slowing down and understanding what you’re actually signing up for.

What Exactly is a 1 Hour Payday Loan?

It’s a short-term loan. You borrow a small amount — usually somewhere between R500 and R8,000 — and you pay it back as soon as your salary comes in.

The “1 hour” part means the lender tries to approve and send you the money within an hour. That’s much faster than a bank loan, which can take days or even weeks.

These loans are designed for:

- Emergency car or home repairs.

- Medical bills that can’t wait.

- School fees or groceries before payday.

What About the “No Credit Check” Part?

Here’s the truth: in South Africa, there’s no such thing as a loan with zero checks. Lenders must follow the National Credit Act, which means they need to make sure you can afford repayments.

So what does “no credit check” mean then?

- It means they don’t always look at your full credit history.

- They’re usually more flexible with people who had problems in the past.

- But they still check your income, payslips, and bank statements.

👉 Think of it this way: they want to know if you can pay them back now, not what happened three years ago.

Why People Choose 1 Hour Payday Loans

- You get money fast, sometimes now now.

- The application is short and online.

- Even with bad credit, you might still get approved.

- The money goes straight into your bank account.

The Downsides You Shouldn’t Ignore

- They’re not cheap. Interest and fees are high.

- Repayment is quick, usually within 30 days.

- If you borrow again and again, you can end up in a debt cycle.

A payday loan is not a solution for long-term money problems. It’s a temporary fix for a short-term emergency.

How to Apply for a Payday Loan in South Africa

- Find a licensed lender

Always check if the lender is registered with the National Credit Regulator (NCR). Instant Fund only connects you to trusted ones. - Apply online

Fill out your personal details, ID, income, and banking info. - Send a few documents

A payslip, 3 months’ bank statements, and proof of address. - Wait for a quick review

The lender checks your affordability. - Get paid

If approved, money goes straight into your account.

Payday Loans vs Other Loan Options

Feature | Payday Loan (1 Hour) | Bank Personal Loan | Credit Card Advance |

Approval Speed | 1 hour | Few days to weeks | Instant |

Loan Amount | R500 – R8,000 | R5,000 – R250,000 | Based on limit |

Repayment Period | 30 days | 12–72 months | Flexible monthly |

Credit Check | Light affordability | Full credit check | Full credit check |

Costs | High | Lower | Medium |

Best For | Urgent emergencies | Long-term needs | Small top-ups |

When a Payday Loan Makes Sense

- Your geyser bursts and needs fixing today.

- You can’t miss a school fee payment.

- You need transport money to get to work.

- You’re short on groceries until salary hits.

Other Options to Think About

- Personal loans for bigger expenses.

- Employer salary advances (some companies offer this).

- Credit unions, which sometimes have better rates.

- Budgeting tools or savings to avoid emergencies in future.

South Africans know that life doesn’t wait for payday. A 1 hour payday loan can give you a quick break when money runs out and an emergency comes up. But it’s not cheap, and it’s not meant to be used all the time.

If you need cash fast, check out Instant Fund The site helps you find safe, reliable lenders so you can cover today’s problems and move forward tomorrow.