Finding an urgent cash loan in South Africa can be difficult and confusing if your money runs out just before payday. Unexpected emergencies require immediate access to money that you need quickly so you can pay for rent or school fees. This is why many South Africans use short-term loans when these situations arise, since most short-term loans have been created with speed, simplicity, and ease-of-use as their primary focus.

- What Is an Urgent Cash Loan?

- Where Can You Find Urgent Cash Loan Providers in South Africa?

- Common Features of Urgent Cash Loans

- Basic Requirements to Apply for an Urgent Cash Loan

- How Fast Are Urgent Cash Loans Paid Out?

- Understanding the Costs of Urgent Cash Loans

- Risks to Be Aware Of When Taking an Urgent Cash Loan

- How Instant Fund Helps Without Lending

- Tips for Choosing a Reliable Urgent Cash Loan Provider

- When an Urgent Cash Loan Makes Sense

- Conclusion

- Frequently Asked Questions

The real difficulty lies not in obtaining urgent cash but rather in finding trustworthy cash loan providers, knowing what is needed to complete the necessary paperwork/loan application process, and knowing what to look out for before requesting a loan. With so many websites offering payday loans, it is easy to be bewildered as to which payday loan websites are legitimate, affordable, and safe.

Contains information about where to find urgent cash loan providers in South Africa and what cash loans are, as well as what to consider before applying for a cash loan. In addition, we will explain how Instant Fund, an online loan-facilitating platform, connects users to a variety of short-term loan options without acting as a lender or broker.

You should have a better understanding of:

- Common Locations for Urgent Cash Loan Providers

- How Payday Loans and Other Short-Term Credit Differ

- What Documentation & Credit History Providers Require For Loan Approval

- What Mistakes to Avoid When Borrowing for Urgent Needs

What Is an Urgent Cash Loan?

Urgent cash loans, or short-term loans, can be used to meet any immediate need for cash. Emergencies such as medical emergencies or the purchase of necessary items (i.e., electricity) are some of the reasons for getting this type of loan.

Typically, urgent cash loans in South Africa are also classified as payday loans because they are:

- Small loan amounts

- Short repayment periods

- Intended to be repaid on your next payday

Why South Africans Use Urgent Cash Loans

Many people choose urgent loans because:

- Approval is often fast

- Applications are done online

- Minimal paperwork is required

- Funds can be paid out the same day Loan

Urgent cash loans are intended to be a quick solution and are based on fast access to funds rather than on large amounts of money for the long term.

Where Can You Find Urgent Cash Loan Providers in South Africa?

1. Online Payday Loan Providers

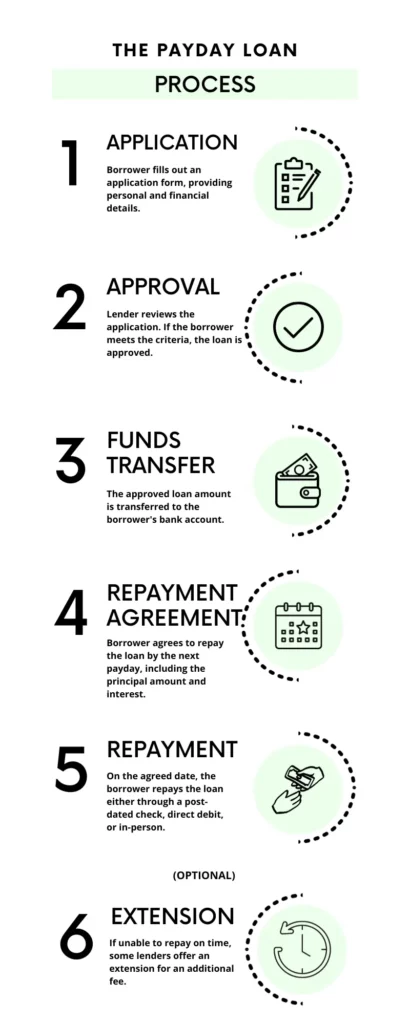

Most urgent cash loan providers in South Africa operate online. Customers are able to complete the entire application and funding process from their computers or mobile phones without ever needing to go into a physical branch.

Online payday lenders typically offer:

- Loan amounts between R500 and R8,000

- Short repayment terms

- Same-day or next-day payouts

The online nature of these businesses means they are the quickest way to get the funds you need when you need them.

2. Microfinance Institutions

Microfinance lenders focus on providing consumers with short-term loans in amounts that would not typically qualify for a bank loan. Most microfinance companies that are licensed to operate in South Africa offer urgent payday loans with clearly defined repayment terms.

Most of the time, microfinance companies are required to be registered with the National Credit Regulator (NCR). The registration of microfinance providers with the NCR creates an additional layer of protection to help consumers make informed lending decisions.

3. Loan Facilitation Platforms (Like Instant Fund)

Loan facilitation companies will not provide loans to the consumer, nor do they act as brokers for other financial institutions. Instead, these companies fill the following roles:

- Provide information about available loan options

- Help users understand eligibility criteria

- Guide borrowers toward suitable providers

Instant Fund operates as a loan facilitation network that assists clients in locating the best urgent cash loan provider. They do this by employing responsible lending practices and not using client information to influence their lending decisions.

Common Features of Urgent Cash Loans

Urgent cash loans tend to share similar features across providers.

Short Repayment Periods

Most payday loans must be repaid within:

- 7 to 35 days

- Or on your next salary date

Smaller Loan Amounts

Urgent cash loans are provided not for large purchases but to assist people temporarily.

Fixed Fees and Interest

In South Africa, all lenders have to adhere to the maximum allowable fee structure. Therefore, the costs of the loan can increase rapidly if the borrower does not pay the lender back within the timeframe.

Automated Assessments

Because lenders typically use automated systems to determine affordability, it allows the approval process can take place quickly.

Basic Requirements to Apply for an Urgent Cash Loan

While requirements vary slightly, most payday loan providers ask for:

- A valid South African ID

- Proof of income or recent bank statements

- An active bank account

- A working mobile number

Some providers advertise loans with “minimal documents,” but basic verification is still required under South African credit laws.

How Fast Are Urgent Cash Loans Paid Out?

Speed is one of the biggest reasons people choose payday loans.

Typical Payout Timelines

- Same-day payout if approved early

- Within 24 hours for most online lenders

- Slight delays on weekends or public holidays

Processing time depends on:

- Bank verification

- Completeness of your application

- The lender’s internal checks

Understanding the Costs of Urgent Cash Loans

Urgent cash loans are convenient, but they are more expensive than long-term credit.

Costs May Include:

- Initiation fees

- Monthly service fees

- Interest charges

- Penalties for late payment

Borrowers should always check the total repayment amount, not just the loan value.

Risks to Be Aware Of When Taking an Urgent Cash Loan

Urgent borrowing can solve short-term problems but create long-term stress if misused.

Common Risks

- Rolling over loans repeatedly

- Borrowing more than you can repay

- Missing repayment dates

- Falling into a debt cycle

A good rule is to borrow only what you can comfortably repay from your next income.

How Instant Fund Helps Without Lending

Instant Fund does not provide loans, approve applications, or collect repayments. Instead, the platform focuses on:

- Sharing information about urgent cash loan options

- Helping users understand how payday loans work

- Encouraging responsible borrowing decisions

This approach allows users to stay informed without pressure to accept unsuitable loan offers.

Tips for Choosing a Reliable Urgent Cash Loan Provider

Before applying, consider the following:

Check Registration

Always confirm the provider is registered with the NCR.

Read the Terms

Pay attention to fees, repayment dates, and penalties.

Avoid Unrealistic Promises

Guaranteed approval claims are often red flags.

Compare Options

Do not apply blindly. Understanding multiple options helps you make better decisions.

When an Urgent Cash Loan Makes Sense

Urgent cash loans are most suitable for:

- One-off emergencies

- Short-term gaps between salaries

- Unexpected essential expenses

They are not ideal for ongoing monthly expenses or long-term debt consolidation.

Conclusion

Finding an urgent cash loan in South Africa is easier today than ever before, thanks to online payday lenders and loan facilitation platforms. These loans exist to help people manage short-term financial pressure, not to replace long-term financial planning.

The key to using urgent cash loans wisely lies in understanding how they work, what they cost, and whether they truly fit your situation. Borrowing quickly should never mean borrowing blindly. Even in urgent moments, taking a few minutes to review terms, repayment dates, and affordability can protect you from unnecessary stress later.

Platforms like Instant Fund play an important role by offering guidance and information without acting as lenders or brokers. This allows users to explore urgent cash loan options with clarity and confidence.

If used responsibly, urgent cash loans can be a helpful financial tool. If misused, they can quickly become a burden. Always borrow with a clear repayment plan and a full understanding of the commitment involved.