Let’s be honest — when money runs out before the month does, panic sets in quickly. Whether it’s a surprise medical bill, school uniforms you didn’t budget for, or simply running low on basics like electricity and groceries, many South Africans find themselves needing fast cash.

And if your credit score is less than perfect? Well, traditional banks often slam the door in your face.

That’s where “no credit check payday loans with guaranteed approval” seem like a lifeline. But are they as simple and safe as they sound?

Let’s unpack the truth behind these offers — what they are, how they work, and what you need to watch out for before you click “apply.”

What Are No Credit Check Payday Loans?

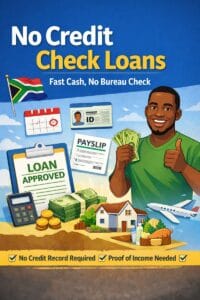

In plain terms, these are short-term loans (usually under R5,000) that don’t require a credit check. Lenders aren’t interested in your past financial mistakes. They just want to see that you earn a stable income and can repay the loan.

Because of that, they’ve become popular among South Africans who are:

- Blacklisted

- Struggling with poor credit scores

- First-time borrowers with no credit history

And the reason they’re called “payday loans”? You’re expected to repay them on or just after your next payday — usually within 30 to 35 days.

Why Are They Marketed as “Guaranteed Approval”?

It’s a marketing trick, to be honest. Lenders can’t legally promise guaranteed approval — even if they don’t check your credit.

South Africa has strict credit laws under the National Credit Act (NCA). Lenders are still required to do a basic affordability assessment. That means looking at:

- Your monthly income

- Your expenses

- Whether you’ll realistically manage the repayment

So yes, approval is easier than at a bank — but it’s not automatic.

⚠️ Real Talk: If someone says they’ll lend you money instantly, with zero documents, no questions asked… be suspicious. That’s not a payday loan. That’s a scam waiting to happen.

The Good, the Bad, and the Risky

✅ What’s Good:

- Fast access to cash (sometimes in hours)

- No judgment on your credit past

- Online applications you can complete from your phone

- Minimal paperwork — usually just ID, bank statements, and proof of income

❌ What’s Risky:

- High fees and interest rates — you could end up paying back a lot more than you borrow

- Short repayment windows — if payday is delayed or you miscalculate, you’re in trouble

- Debt traps — rolling over loans can quickly become a financial mess

How to Tell If a Lender Is Legit in South Africa

Before applying for any payday loan, ask yourself:

- Is the lender registered with the NCR?

Every legal lender in SA must be registered with the National Credit Regulator. You can check at ncr.org.za. - Do they ask for upfront fees?

If a “lender” wants you to send money before giving you a loan, it’s a scam. Full stop. - Are the repayment terms clear?

You should see exactly how much you’re borrowing, the fees involved, and the final repayment amount. - Can you afford the loan — really?

Just because it’s easy to get doesn’t mean it’s smart. Never borrow more than you can repay comfortably.

Step-by-Step: How to Apply for One Safely

Here’s how the process usually works if you go with a reputable lender:

- Choose your lender – Compare a few online. Look for transparency, clear terms, and NCR registration.

- Complete the online application – Takes 10–15 minutes.

- Submit your docs – Typically:

- SA ID

- 3 months’ bank statements

- Latest payslip or income proof

- Wait for assessment – Many respond within the same day.

- Loan is paid out – If approved, the money is deposited into your bank account.

Real Life Example:

Let’s say Lindiwe, a teacher from Pietermaritzburg, had a burst geyser and no emergency fund. With a low credit score from a store account she defaulted on two years ago, her bank wouldn’t help.

She applied for a payday loan online, submitted her payslip and bank statements, and had R2,000 in her account the next day. She paid it back on her next salary, plus a R300 fee.

Lindiwe didn’t love the extra cost — but in that moment, it helped her avoid a far bigger disaster.