Eligibility Criteria

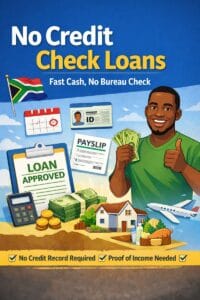

No credit check loans are designed for individuals who may have a poor credit history or no credit score at all. These loans bypass the traditional credit check process, which involves assessing an applicant’s creditworthiness based on their credit score, payment history, and debt management. Instead, lenders may evaluate other factors like income, employment status, and ability to provide collateral.

- Eligibility Criteria

- How the Application Process Works

- No credit check loan are such as a financial aid

- The benefit of no credit check loan in South Africa

- No need to fax any document to the loan provider

- Purposes for which the loan amount can be utilized

- Eligibility criteria that the applicant has to follow

- What is the meaning of no credit check?

- How can the applicant apply for an no credit check loan in South Africa?

While specific requirements can vary between lenders, here’s a general overview of what you might need to qualify for a no credit check loan:

How the Application Process Works

- Age: You must be 18 years or older.

- South African Citizenship: You must be a South African citizen.

- Bank Account: You must have a bank account.

- Employment: You must have a permanent job.

- Some lenders may require a minimum monthly income, such as R5,000 or more.

- Documentation: You’ll typically need to provide personal and financial information, including a South African ID, proof of income (like recent bank statements or payslips), and possibly proof of address (such as a utility bill).

The application process for no credit check loans is generally straightforward and often conducted online. Here’s a step-by-step guide:

It’s crucial to be aware of the potential risks associated with no credit check loans

No credit check loan help you to handle the burden of sudden cash needs. It also helps to deal with unexpected expenses, such as car repair, medical expenses, electricity bills, etc. The borrower does not need to repay the whole loan amount at once. He/she can make their repayments on a weekly or monthly basis, hence it proves from the name of the loan that is: No credit check loan.

If you are well known about payday loans, then you can easily understand what no credit check loan South Africa is. Because these are very much similar to payday loans.

No credit check loan are such as a financial aid

No credit check loan are an aid for those people who have a limited source of income. To solve money problems the loan provider has introduced No credit check loan in South Africa. These loans unsecured in nature, the loan provider doesn’t ask for any collateral or credit a check for loan approval. With the help of the loan, the individual can solve the money problem in a short span. The amount of loan completely depends upon the applicant’s capacity which he/she can repay on time. The borrower can select a repayment period as per his choice.

The benefit of no credit check loan in South Africa

The amount issued to the applicant can use for any purpose. There is no restriction on its use which means an applicant can freely spend the money to fulfill their needs. There is a large number of purposes for which the amount can be utilized such as to pay unforeseen hospital bills, telephone bills, household expenses, car repair expenses, small vacation, and many other purposes.

The basic motto of the online loan is to save your time. As the applicant can apply for a loan without going anywhere. And not to deal with any complex paperwork or with other formalities. As you all know, the complicated paperwork formalities consume your time very much unnecessarily.

No need to fax any document to the loan provider

The applicant doesn’t have to fax any document to the loan provider. When you apply for no credit check loan South Africa you will get the loan without dealing with the complex paperwork or formalities.

Purposes for which the loan amount can be utilized

Unforeseen medical expenses, dental care:

Life is unpredictable. What happen in another second nobody knows! Any health issue arises, should be solved on time. Any individual who doesn’t have sufficient money with him, can get these loans and make use of this amount for an appropriate purpose.

Household expenses, house renovation, car repair:

Sometimes many unexpected expenses suddenly pop up and they have to pay on time. Expenses like someone renovating their house they need money. Then, they can apply for no credit check loan. On the other hand, a car or any other vehicle is very important in our lives, are using to go to work or school. So, proper maintenance and repair of a car become a must.

Pending telephone bills, electricity bills or other utility bills:

The borrower can use the borrowed sum to pay off his due bills on time. These bills need to be paid on time otherwise the individual has to suffer a lot. As these bills or expenses demand instant action.

Eligibility criteria that the applicant has to follow

The applicant has to fulfill below eligibility criteria:

- The applicant should be a permanent south Afican citizen

The applicant must be a South African. If an individual wants instant money he may apply for instant Fund loans. But only is he/she must a South African resident.

- He must be adult i.e. above 18 years

A person who is thinking to apply for a loan, must at the age of 18 years or above this. If he/she will not satisfy this condition they will not apply for the loan.

- Must have a verified bank account

To receive the fund the applicant must have an active bank account that can accept electronic transfers too. Once the loan approved then, the amount will directly deposit to the applicant account.

- The borrower must receive a regular income

The borrower must receive a regular income to apply for a loan. If he is not receiving a regular then, it becomes necessary that he should be employed for part-time or receiving income from other sources.

What is the meaning of no credit check?

Anybody can apply for a loan. Whether he has a bad credit record or good credit record this never makes a difference on the approval for a loan. As the loan provider approves the loan to those who need instant money. The loan provider never asks or tries to check the credit records of the applicant. Because this will not affect the loan approval.

How can the applicant apply for an no credit check loan in South Africa?

To get the loan the applicant has to provide some basic information which takes less time.

- The applicant has to fill up an online application form

Complete our online application form if you want money. The form is very simple and easy to understand. It takes less than 10 minutes to fill out.

- Submission of application form

The next is the submission of the application form. Just with a single click on the mouse, on the button “apply now” the application submitted.

- Get fund

After the loan approval, the amount will send to the applicant bank account. You receive money directly in your bank account within 24 hours.